Qualcomm Automotive Primer

Qualcomm’s Next S-Curve?

One line from Qualcomm’s recent earnings call caught my ear:

We delivered QCT automotive revenues of $959 million, reflecting 59% year-over-year growth on increased content in new vehicle launches with our Snapdragon Digital Chassis platforms. Source

Nearly $1 billion in quarterly revenue, growing 59% YoY!!

Sure, it’s peanuts relative to smartphones:

And yes, growth from a smaller base is easier. Regardless, at first blush it seems automotive can be a sustainable growth driver for Qualcomm in the future. CEO Cristiano Amon appears to feel the same way:

We continue to see strong demand in automotive for the Snapdragon Digital Chassis, and we are on course to reach our fiscal '29 revenue target of $8 billion.

Doubling the current $3.8B run rate to $8B in revenue by 2029 implies roughly a 20% compound annual growth rate. That might not be AI datacenter growth… but it’s nothing to sneeze at!

So what’s Qualcomm’s play in automotive? Is it differentiated and sustainable? How do they hold up against other platform players?

While I’m relatively new to automotive, my experience in semiconductors and AI made Qualcomm’s expansion into this space too important to ignore. I attended the recent Qualcomm Automotive Workshop in San Diego to hear directly from their team, and there’s plenty to unpack.

So here we go: a zero-entry approach to Qualcomm automotive, wading in gently from the company’s roots and progressing toward the automotive deep end.

Specifically, we’ll explore why Qualcomm’s move into automotive makes strategic sense. Then we’ll zoom into Snapdragon Ride for ADAS and autonomy, the Snapdragon Cockpit, and how Qualcomm’s approach compares to Nvidia’s.

Today’s post falls short of a full analysis including competitors like Mobileye and Intel Auto. But don’t worry—my weekly cadence means more to come eventually 😎. I’ve got to hit publish now since I’m heading to Seattle next week to learn more about AI and silicon at Microsoft.

The Q Beyond the COM

Qualcomm started in connectivity; the name comes from “QUALity COMMunications.” Think CDMA, 3G, and 4G modems. If you haven’t watched or listened to this Qualcomm history from Acquired, do give it a listen!

Qualcomm, or “Quality Communications” — despite being one of the largest technology companies in the world, few people know the absolutely amazing technological and business history behind it. Seriously, this story is on par with Nvidia, TSMC and all the great semiconductor giants. Without this single fabless company based in San Diego, there’s almost no chance you’d be consuming this episode on whatever device you’re currently listening on — a fact that enables them to earn an incredible estimated $20 for every new phone sold in the world

Foreshadowing a bit here. If every car is connected, could Qualcomm take a cut of each one sold… not just for connectivity, but for compute too?

The Birth of Snapdragon

Qualcomm established a highly lucrative IP business centered on CDMA patent licensing and wireless standards, generating royalties from the majority of 3G and 4G mobile devices. To build upon its licensing division (QTL), Qualcomm created a complementary chip business (QCT), applying its strong capabilities in RF design and signal processing to develop and market chips for cellular communication.

The increasing capabilities of mobile phones spurred an industry-wide move toward integration. Rather than employing discrete chips for individual tasks, manufacturers adopted single-chip Systems-on-a-Chip (SoCs) that included components such as the modem, processor, and memory. Qualcomm capitalized on this transition, expanding into full SoCs for these newfangled smartphones under the brand name Snapdragon.

EETimes covered Qualcomm’s foray into compute and SoCs in this 2007 article:

Back in 2005, Qualcomm announced that it had licensed the ARMv7 instruction set architecture and was working with ARM to create its own high-performance [CPU] core based on that architecture. The new core was dubbed "Scorpion," and at the time it was announced, Qualcomm didn't disclose much about it except that it would run at 1 GHz in a 65 nm process and would be customized to provide a high level of performance and energy efficiency in its target mobile applications. Exactly how this combination would be achieved was not revealed, which is typical of Qualcomm; historically, the company has disclosed few details about the processor cores that live inside its chips.

Then in 2006, Qualcomm announced a new chip platform, "Snapdragon," in which the Scorpion core would be used alongside several other processors and co-processors. According to Qualcomm, Snapdragon will serve a range of high-performance mobile applications, such as high-end smartphones and mobile internet devices. Still, there was little information about the Scorpion core itself.

Qualcomm has evolved the Snapdragon SoC significantly over the past decades, now to Snapdragon 8 Elite on 3nm process technology with the Oryon core. (The Snapdragon’s CPU history is an interesting conversation for another time!)

Smartphone Plateau, Time for a New S-Curve

Snapdragon powered Qualcomm’s growth as Android smartphones went mainstream. But the market matured relatively quickly:

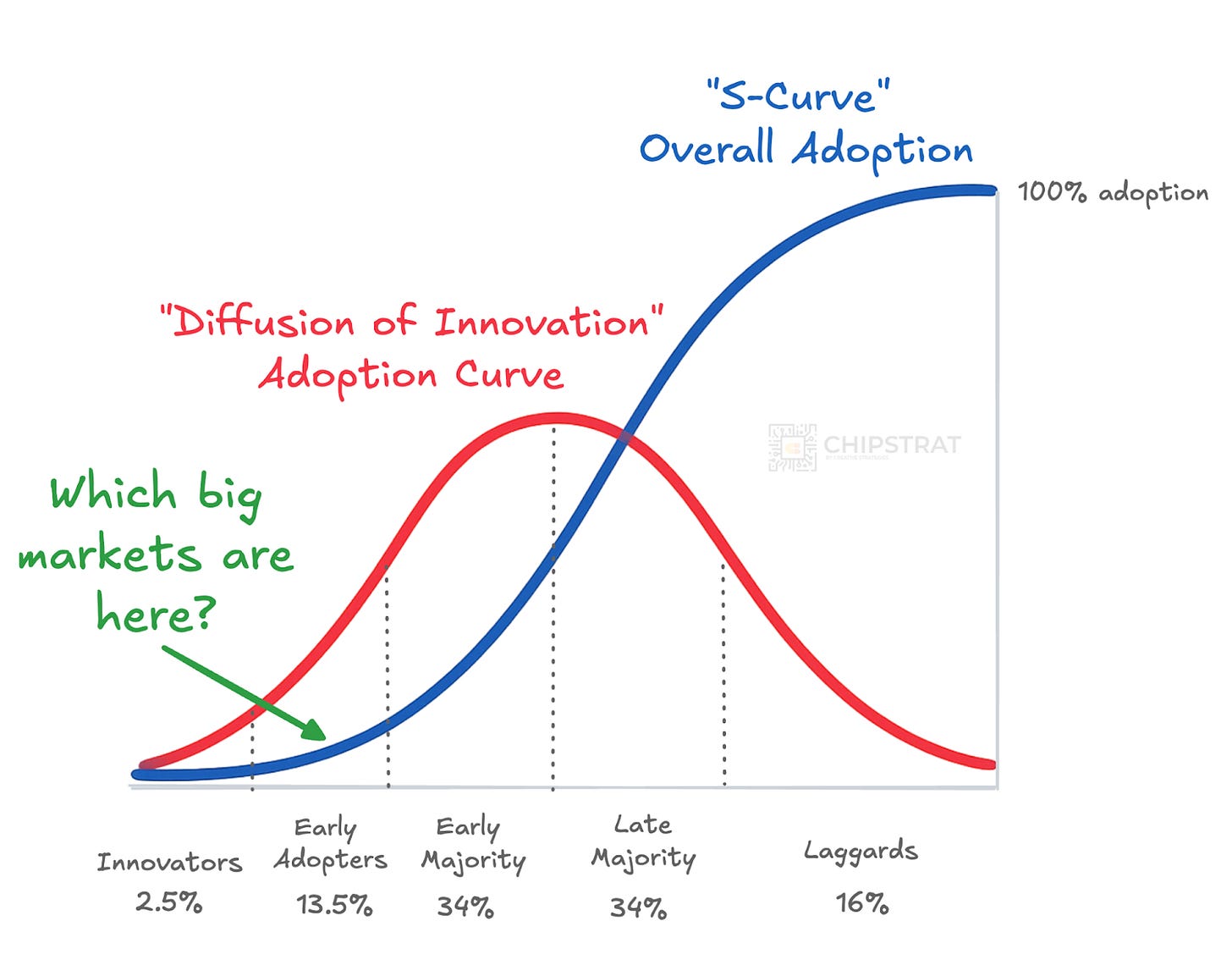

Today, the smartphone industry sits near the top of the classic S-curve:

Naturally, Qualcomm has been looking to expand to other growth markets. They want to jump into other promising markets early in that S-curve so they can ride it to the top:

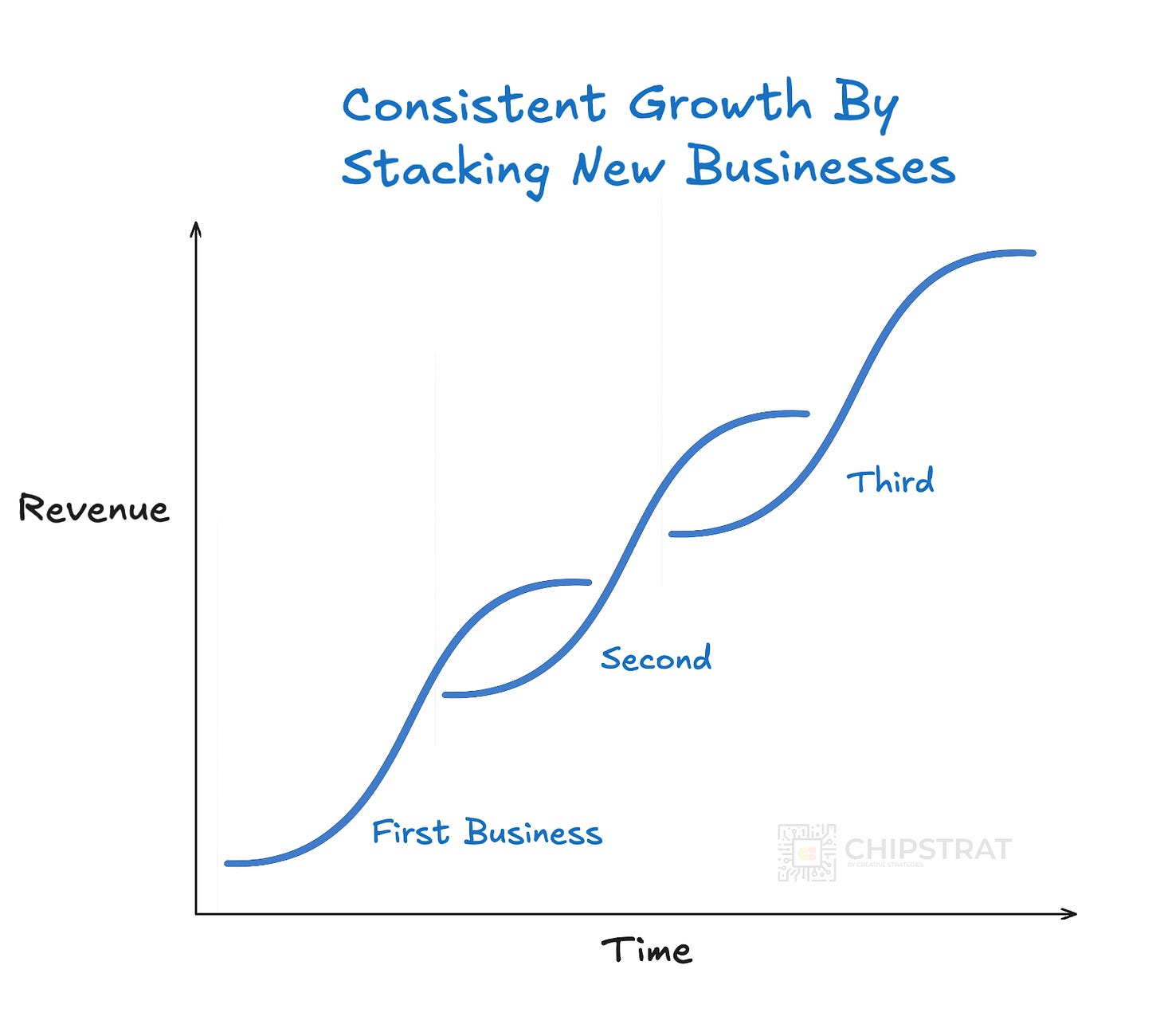

This will allow Qualcomm to stack S-curves if you will:

Of course, this requires identifying new markets that are large and addressable for Qualcomm:

And, in that growing market, Qualcomm must deliver a product capable of crossing the chasm into mainstream adoption.

Well, guess what? The new era of automotive promises to be a big, addressable market with significant silicon content needs that Qualcomm can meet.

From Old Auto to New Auto

The auto industry feels mature. Everyone already has a car, right? We’re at the top of the S-curve?

But the industry is undergoing a major transition, moving from the “Old Auto” era of ICE vehicles and cheap microcontrollers to a “New Auto” era defined by high-performance silicon, connectivity, electrification, and autonomy.

It’s a shift from analog and offline to digital and connected.

And in that New Auto era, we’re early on the S-curve.

Consider China, where companies like Xiaomi Auto—born from a leading smartphone brand—are entering the car market. There was a time when the idea of a smartphone company making cars was crazy, but not anymore. New Auto needs connectivity, compute, displays, and AI.

Hey, that looks a lot like the needs of a smartphone.

Consumers are already prioritizing New Auto features. In China, those opting for EVs from top Chinese brands rather than German, Japanese, or American ones often do so because of better New Auto features:

Of course, we see these features in demand too in America, from Tesla to Rivian.

To play ball in New Auto, whether a legacy carmaker or a new brand, you need hardware and software that enables connectivity, displays, electrification, and automated driving.

And that’s where Qualcomm comes in.

SoC Convergence, from Smartphone to Car

What does the SoC in Qualcomm’s latest smartphone look like?

Here’s a functional block diagram from their 2024 Snapdragon Summit — well, here’s Chris Patrick with the block diagram visible in the background 😂 Notice the CPU, GPU, NPU, and communication blocks:

In this smartphone SoC, we see the same building blocks New Auto needs: connectivity, compute, displays, and sensor fusion.

But as Levar Burton used to say in Reading Rainbow: You don’t have to take my word for it! Here’s a peek at Rivian’s electronics, from their June 2024 investor day. Notice anything?

We see autonomy, infotainment (displays and connectivity), sensor processing and fusion, and more zonal controllers to handle even the basic functions.

Qualcomm clearly has the proverbial Lego blocks needed to make an New Auto SoC.

Snapdragon for Automotive

Before we dive in. I’m writing as if Qualcomm is just getting into automotive, but in fact they’ve dabbled in automotive for over 20 years.

Of course, it’s no surprise they started with connectivity chips. For OnStar.

Remember when OnStar first came out back in the day?

They’ve made a lot of progress since then, as judged by this logo slide.

Automakers young and old, from America to Gemany to Asia: Ford and Chevy, Tesla and Rivian, BMW and Mercedes, Honda and Hyundai, Geely and XPENG.

Something is working. What’s Qualcomm’s strategy?

The Snapdragon Digital Chassis

At the heart of Qualcomm’s strategy is the Snapdragon Digital Chassis platform. I know – it’s a mouthful.

Think of Qualcomm’s “Snapdragon Digital Chassis” as the umbrella brand for its entire automotive portfolio:

As a bit of analogy, consider the portfolio brand “Microsoft Office”. Office is the name of the suite of software products, and it houses individual solutions like Word, Excel, PowerPoint. Each solution is crafted for a particular domain, e.g. document creation (Word), data analysis (Excel), or visual communication (PowerPoint).

In Qualcomm Automotive’s case, Snapdragon Digital Chassis is a portfolio of solutions like Cockpit (in-cabin displays), Ride (automated driving / ADAS), Auto Connectivity (connectivity), and Car-to-Cloud (services).

Why does Qualcomm include the “Snapdragon” brand in the name? Unlike the Microsoft analogy, Qualcomm’s solution is hardware and software. And the hardware is branded Snapdragon.

Because Snapdragon automotive SoCs have a lot of the same IP blocks as the mobile phone SoC, it makes sense to carry the Snapdragon branding with the SoC across the different domains (mobile, automotive, PCs, XR, etc).

After all, recall that mobile SoC and then check out the infotainment-centric SoC, Snapdragon Cockpit Elite:

The Snapdragon automotive SoCs share significant IP with Qualcomm’s smartphone chips: CPU, GPU, NPU, Spectra ISP, memory, etc. That shared foundation justifies extending the Snapdragon brand across multiple domains from mobile to automotive (and XR, PCs, etc).

Strategically, it’s a smart move to reuse successful IP and tailor it to meet the needs of other growing markets. Stack those S-curves! This is the play, from IoT to automotive to XR. AI PCs and cloud opportunities, we’ll discuss that another day.

Ok, we’ve been gently wading in. But now let’s go deep.

Behind the paywall, we’ll dive into Snapdragon Ride and Snapdragon Cockpit and then we’ll compare and contrast Qualcomm Automotive with Nvidia’s automotive efforts.

By the way, on my visit to Qualcomm they didn’t just show PowerPoint slides; I went for a spin in a Snapdragon-powered automated driving demo: