Credo’s Reliability Thesis

Can Credo Reach Beyond AECs?

Credo became famous by inventing Active Electrical Cables, single-handedly extendeding the industry maxim “copper if you can, optics if you must”.

Start here if you’re new to Credo and AECs.

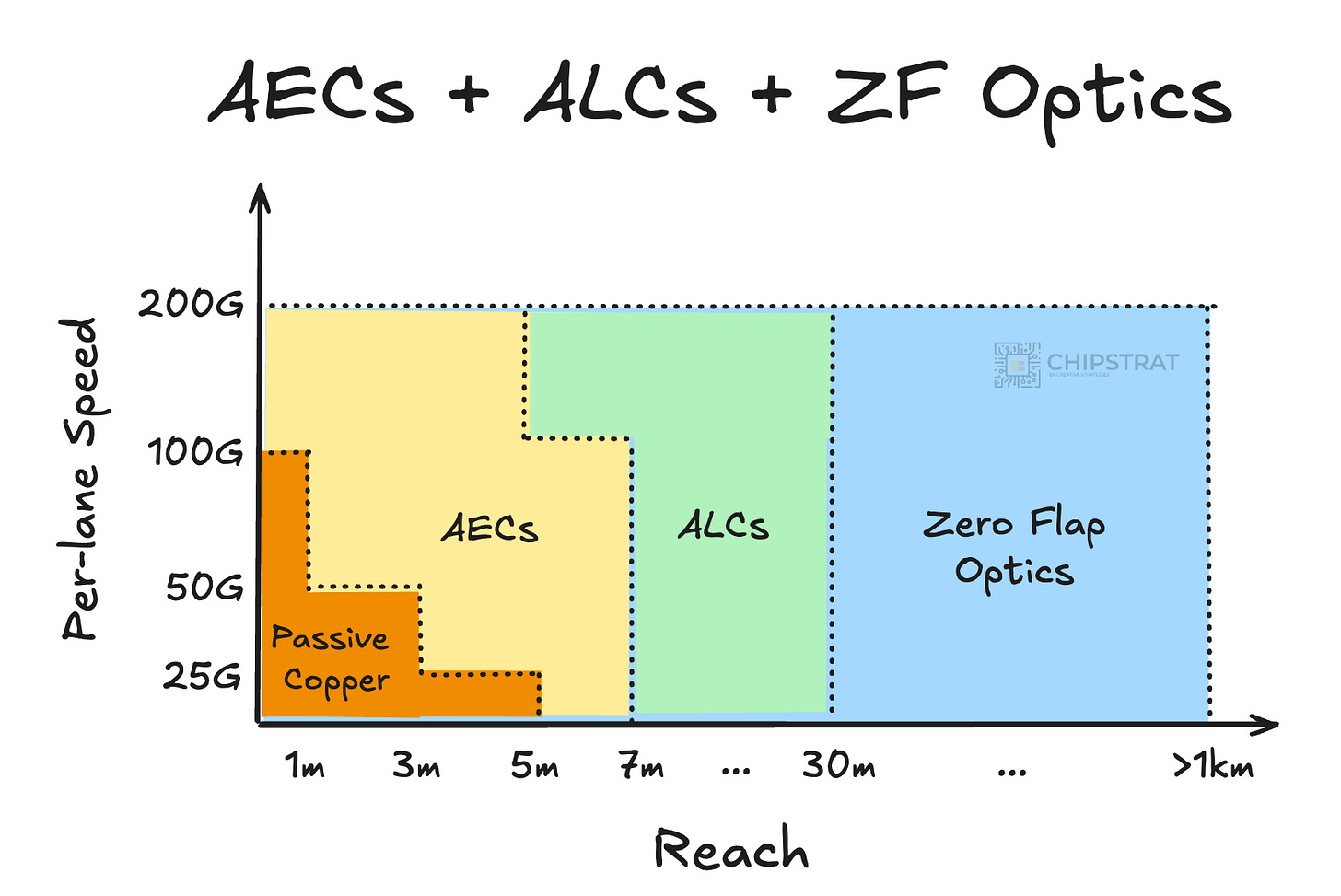

But AECs have a proverbial elephant in the room. The industry is constantly pushing for higher lane speeds, which steadily shortens copper’s reach. Today’s AECs top out around 7 meters, and when the industry upgrades to 200G/lane, AECs only reach ~5 meters. That works inside the rack or adjacent-rack connections, but won’t work for row-level connectivity.

This brings about hard questions. If AEC reach is capped and shrinks with each speed jump, what is Credo’s play beyond AECs? Where does the company stand in optics, and how does it avoid becoming just another participant in an increasingly crowded market?

Good news. Credo isn’t a one-trick pony. Over the past several months, they’ve rolled out products that deliberately extend reach in both directions while keeping the same core value prop that made AECs a hit in the first place: reliability. On the optical side, this includes Active LED Cables (ALCs) built on micro-LED technology acquired through Hyperlume, as well as its ZeroFlap optical transceivers.

Credo now has a connectivity portfolio that spans roughly 1–5 meters, 5–30 meters, and beyond 30 meters.

At the same time, Credo is pushing in the opposite direction. OmiConnect moves down the curve, targeting die-to-die and system-level interconnects measured in millimeters to inches.

Next comes the part that actually matters for those tracking Credo closely.

Let’s walk through Credo’s broadening portfolio and the differentiators that underpin it. I’ll include relevant management commentary.

Behind the paywall, I walk through

How Credo competes in a crowded optical transceivers market

Whether Active LED Cables create a new category and incremental TAM, and if the AEC playbook can repeat

How much growth remains in AECs as lane speeds rise and reach compresses

Key risks, including customer concentration and CPO versus NPO dynamics

If you’re deciding whether Credo’s growth story extends past AECs, this is the place to look!