AWS Is Missing the AI Infra Moment

Amazon stock depends on AWS, but AWS is struggling with GPU shortages, power constraints, and slow growth

The cloud wars are heating up, and it’s not looking good for AWS.

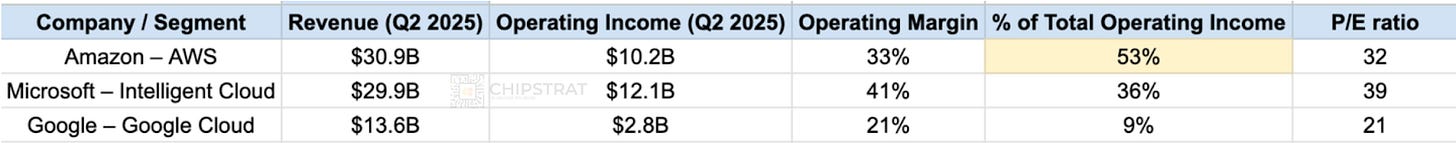

Among the three hyperscalers, Amazon is by far the most dependent on its cloud business for profit and growth:

This is a race Amazon cannot afford to lose!

Let’s unpack why, then look at the implications and next steps for AWS.

Dependence on Cloud

Amazon

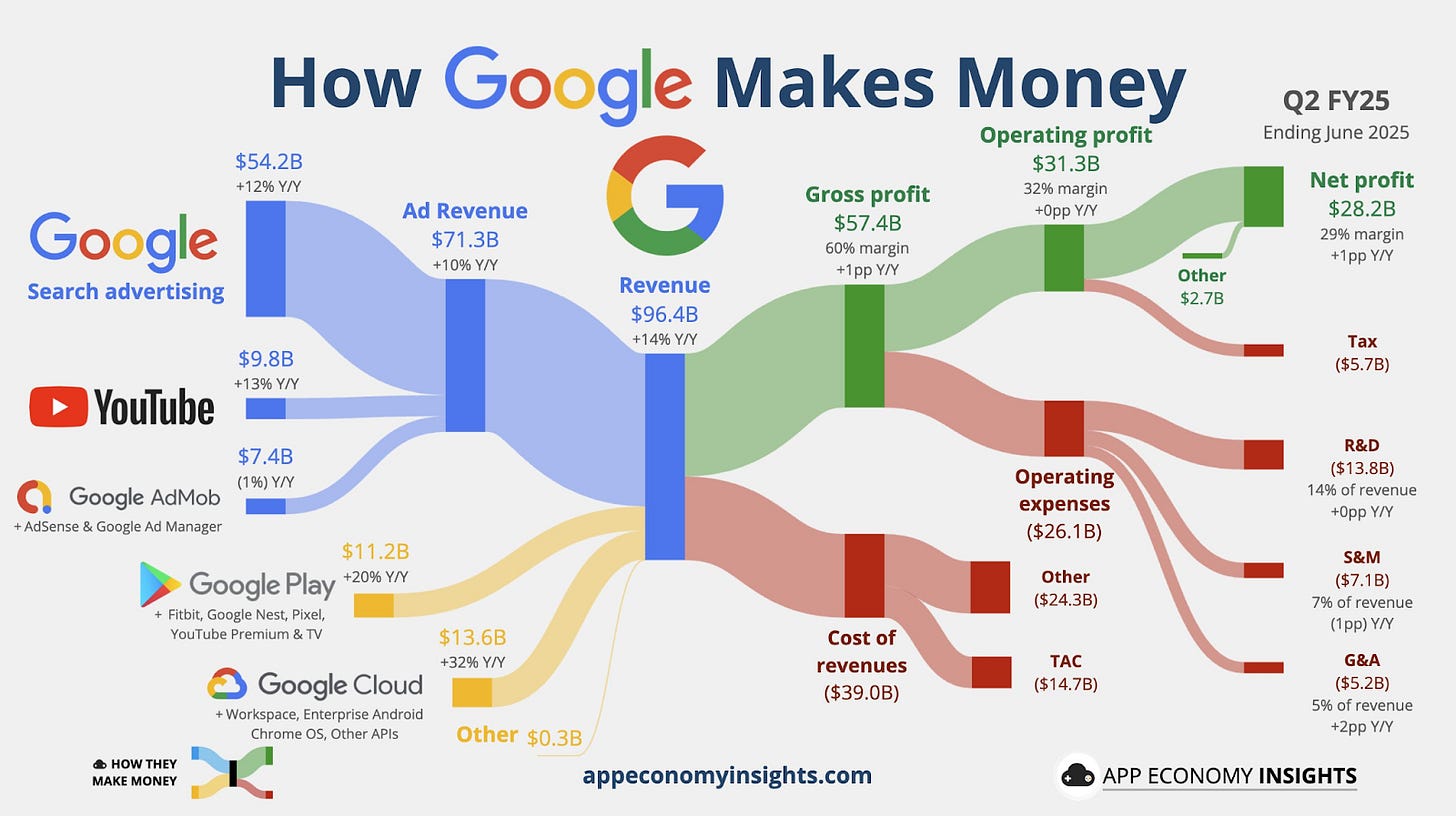

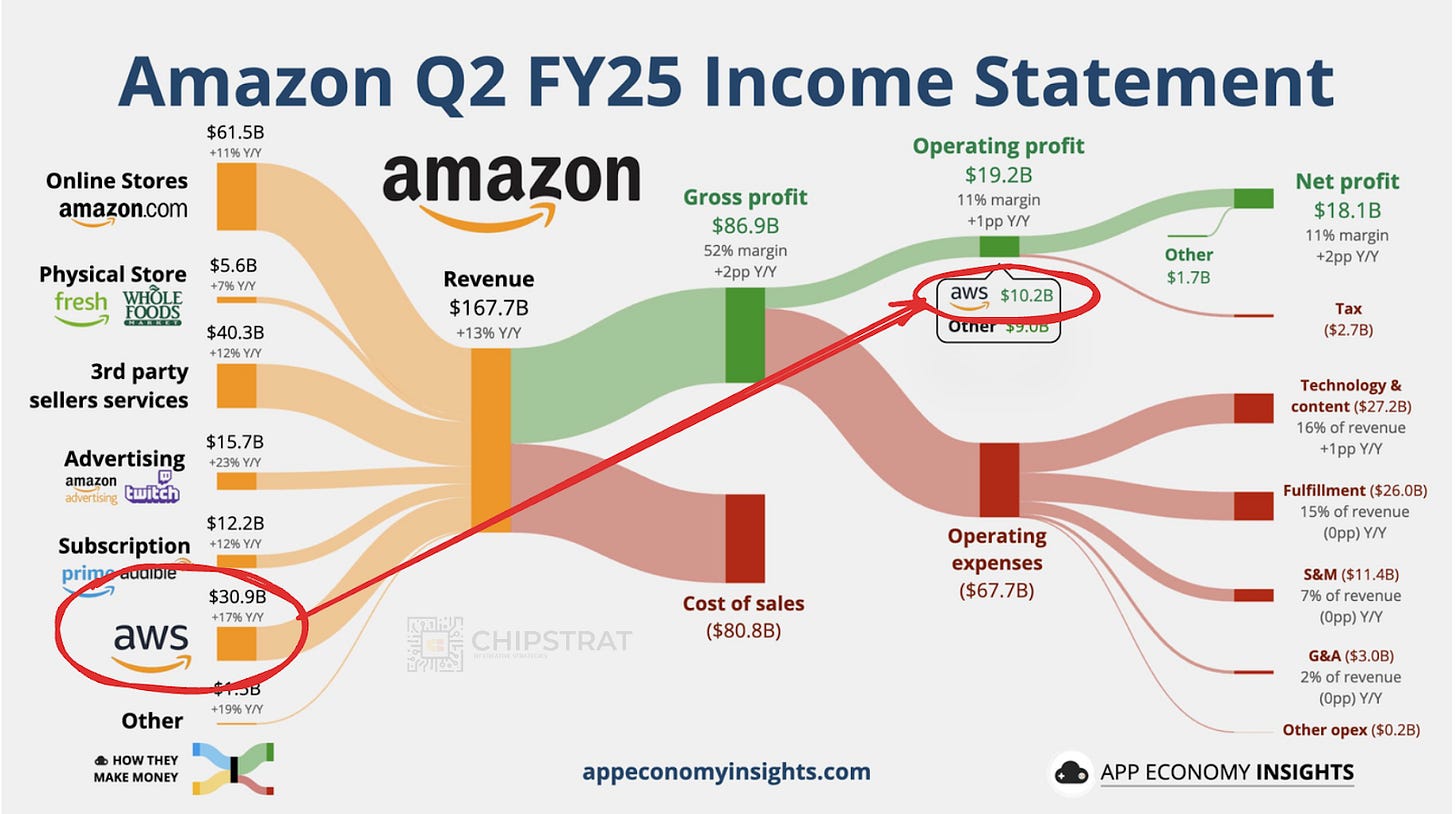

Amazon is first and foremost a retailer; 82% of Q2 revenue came from the retail business, while 18% ($30.9B) came from AWS. Yet this is a top-line illusion; half of Amazon’s profits come from AWS!

Retail businesses have slim margins. From Amazon’s recent 10Q we see paltry margins:

North America: $7.5B operating profit at ~7.5% margin

International: $1.5B operating profit at ~4.1% margin

But the cloud business is a different story:

AWS: $10.2B operating profit at ~32.9% margin

As a consequence, AWS contributes significantly to the bottom line.

AWS contributed 53% of total operating profit despite being only 18% of revenue!

I’m a visual thinker, and App Economy illustrates it nicely:

Amazon’s cloud business pulls up corporate margins and contributes significantly to operating profit.

Most think of Amazon as the world’s largest online retailer, but its operating profit suggests it’s really a cloud services company with a massive, low‑margin retail arm attached. 😅

Google

Google is an information and entertainment company built on an exceptionally profitable advertising model. Or, put another way, an advertising company with a highly effective information and entertainment distribution engine.

This “Services” division, as defined in the 10‑K, generated 86% of quarterly revenue. So, not unlike Amazon, the core business accounts for over 80% of revenues.

But Google’s core business has better margins and contributes the majority of operating profit.

Google Services: $82.5B revenue, contributing $33.1B in operating profit with margins of ~40.1%

Google Cloud: $13.6B revenue, contributing $2.8B in operating profit with margins of ~20.6%

So Google Cloud contributes only 14% of Google (Alphabet) top-line revenue and even less (~9%) of total operating income. Google is much less dependent on it’s cloud business than Amazon.

Microsoft

What about Microsoft?

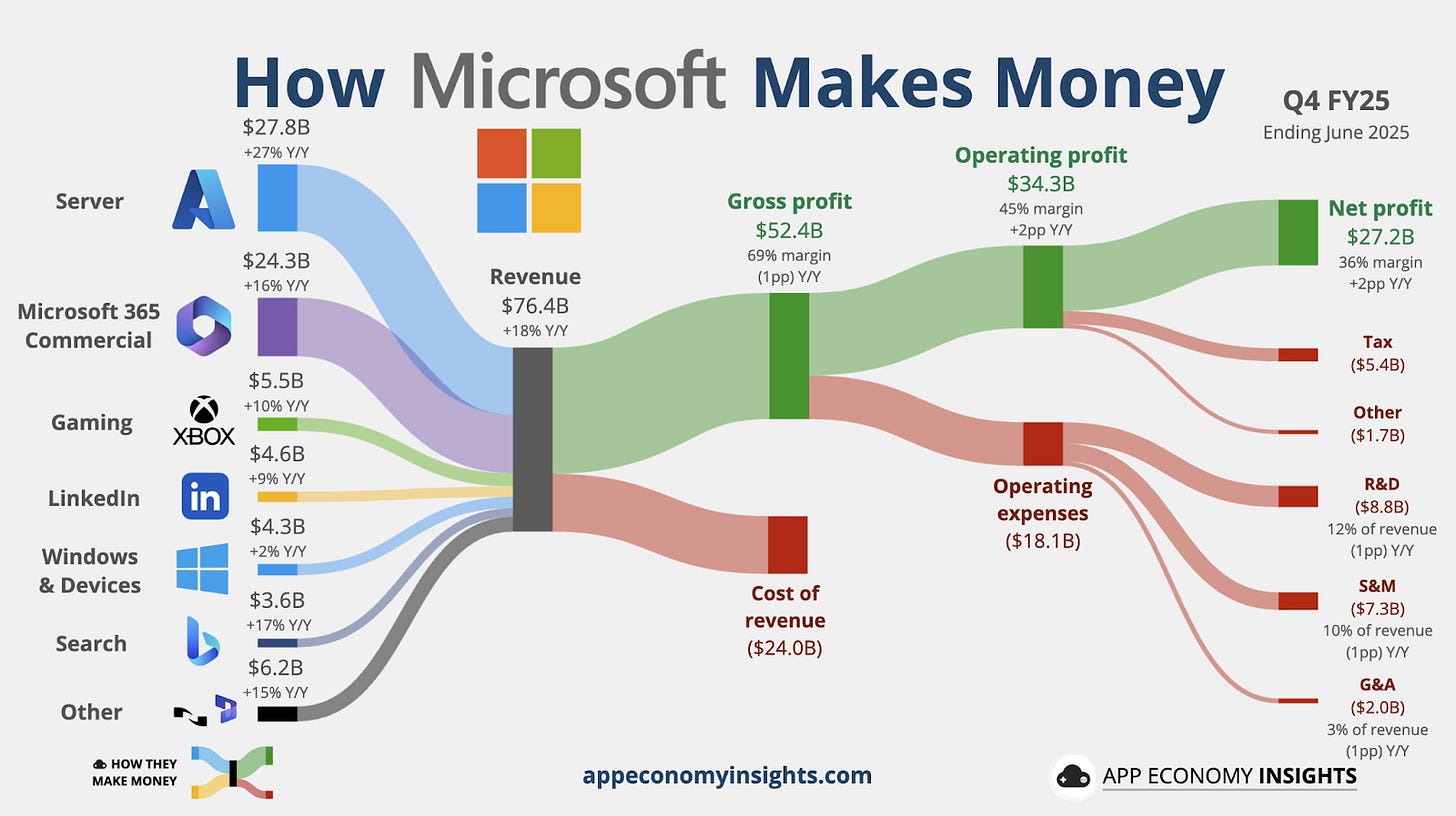

Microsoft’s operating segments include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.

That didn’t explain much 😅 so broadly speaking you can think of these as:

Productivity Apps (Office, etc)

Cloud and Server (Azure, SQL Server, etc)

Other Stuff (Xbox, Surface, Windows, Bing, Edge)

(The specific segment details are here)

Notice how Microsoft’s revenue is more evenly distributed than the others; the breakdown is roughly 43% apps, 38% cloud, 20% other.

So nearly 40-40-20. Nice.

As far as operating profit and margins, as you’d expect, the software margins are highest, cloud is next, and other stuff is last:

Productivity and Business Processes

Revenue: $33.1 billion

Operating income: $19.0 billion

Operating margin: 57.4%

Intelligent Cloud

Revenue: $29.9 billion

Operating income: $12.1 billion

Operating margin: 40.6%

More Personal Computing

Revenue: $13.5 billion

Operating income: $3.2 billion

Operating margin: 23.7%

The “other stuff” bucket is weighed down by low‑margin hardware like Xbox and Surface, with Windows, Bing, and Edge not large or profitable enough to move the segment’s margin much higher.

Comparison

Putting it all together, we see that Amazon’s profit is very dependent on AWS.

Amazon trades at a price-to-earnings ratio of 32 (at the time of writing), significantly higher than most retail/logistics peers, which typically have low-to-mid teens ratios (e.g., Target at 11). Walmart is a different story for another time.

This is because investors value AWS as a tech growth business within Amazon.

But this premium is only defensible if AWS keeps growing at a rate that supports a cloud leader narrative.

So how’s that going for AWS?

Eric Flaningam at Generative Value has a fantastic post with all the charts we need:

Let’s go.

Cloud Battle

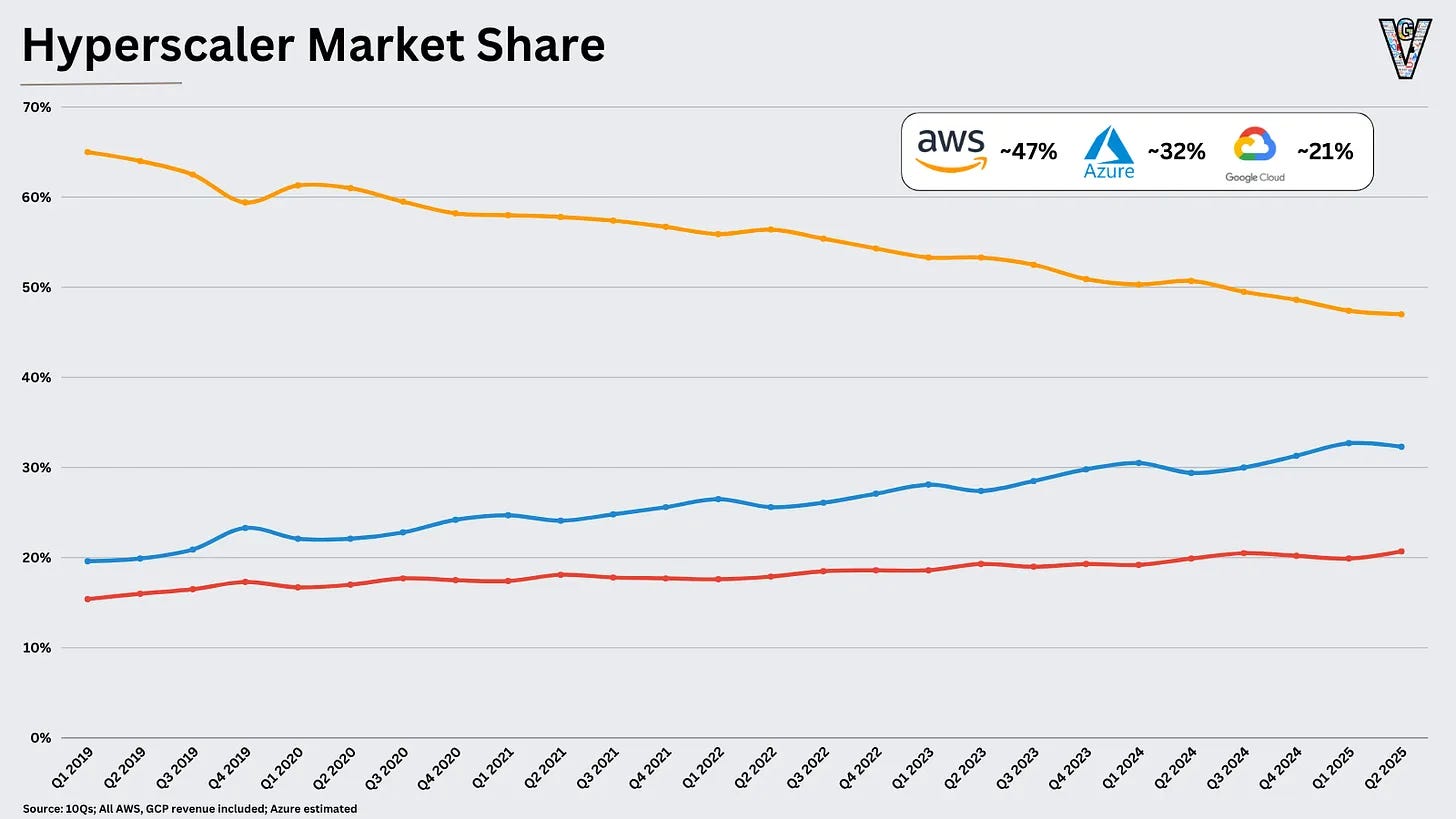

AWS was first to the cloud and held a dominant lead, but Microsoft and Google have been steadily chipping away:

AWS’ long downhill trajectory reminds me of the Giant Slide at the Iowa State Fair:

Except the fair slide is fun.

Market share, though, doesn’t tell the whole story. The total addressable market has been expanding rapidly, even as rivals carve out their portion. And AWS’s slip isn’t necessarily a sign of weak products. Competitors have been aggressive with tactics like bundling Microsoft 365 and Azure Credits or offering huge startup packages like $350K from Google Cloud. This is all good and to be expected as competition tries to chase down the incumbent.

But the big question is how each cloud is faring in the GenAI era.

Did this technological revolution provide an opportunity for Microsoft or Google to catch up?

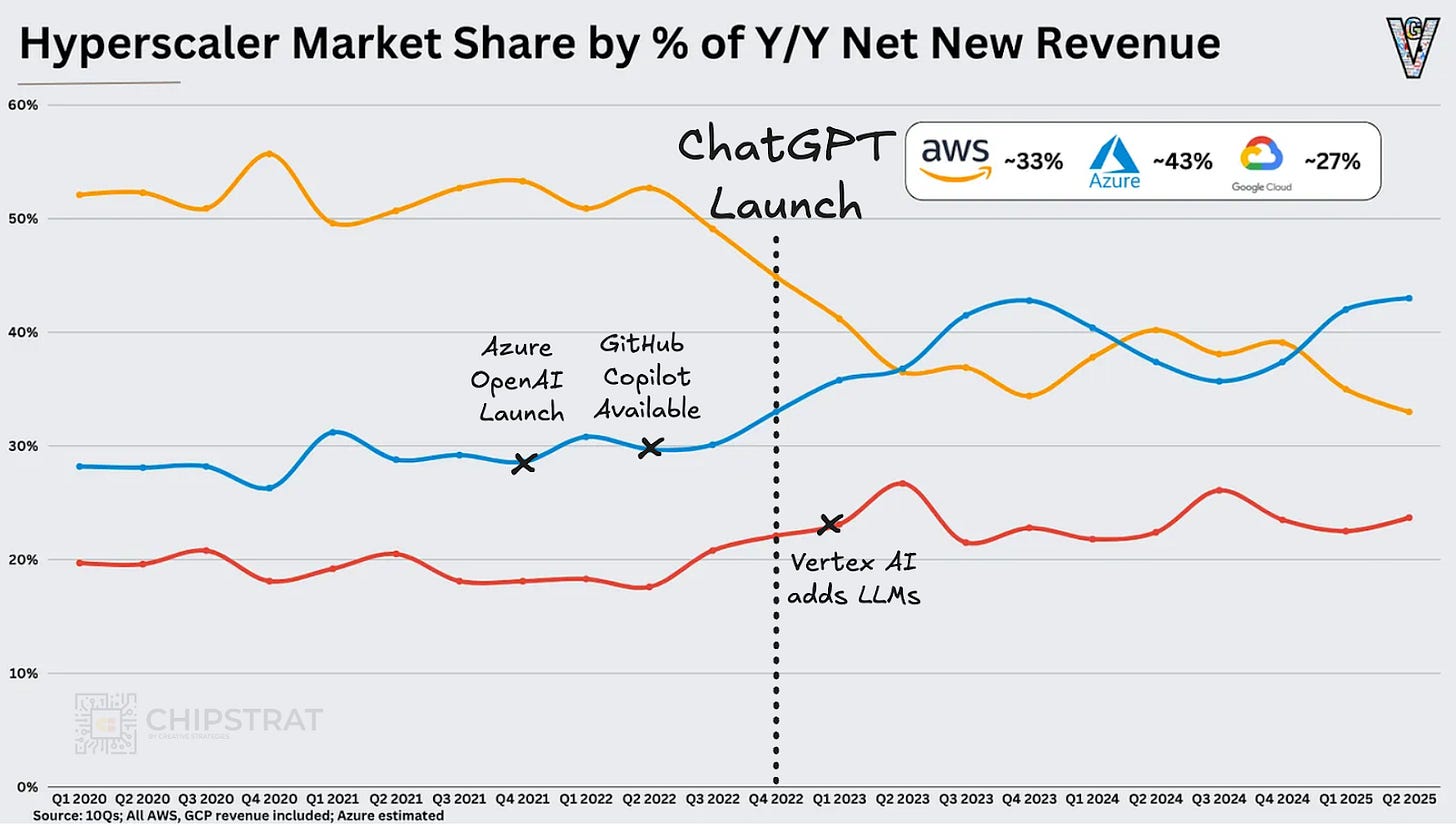

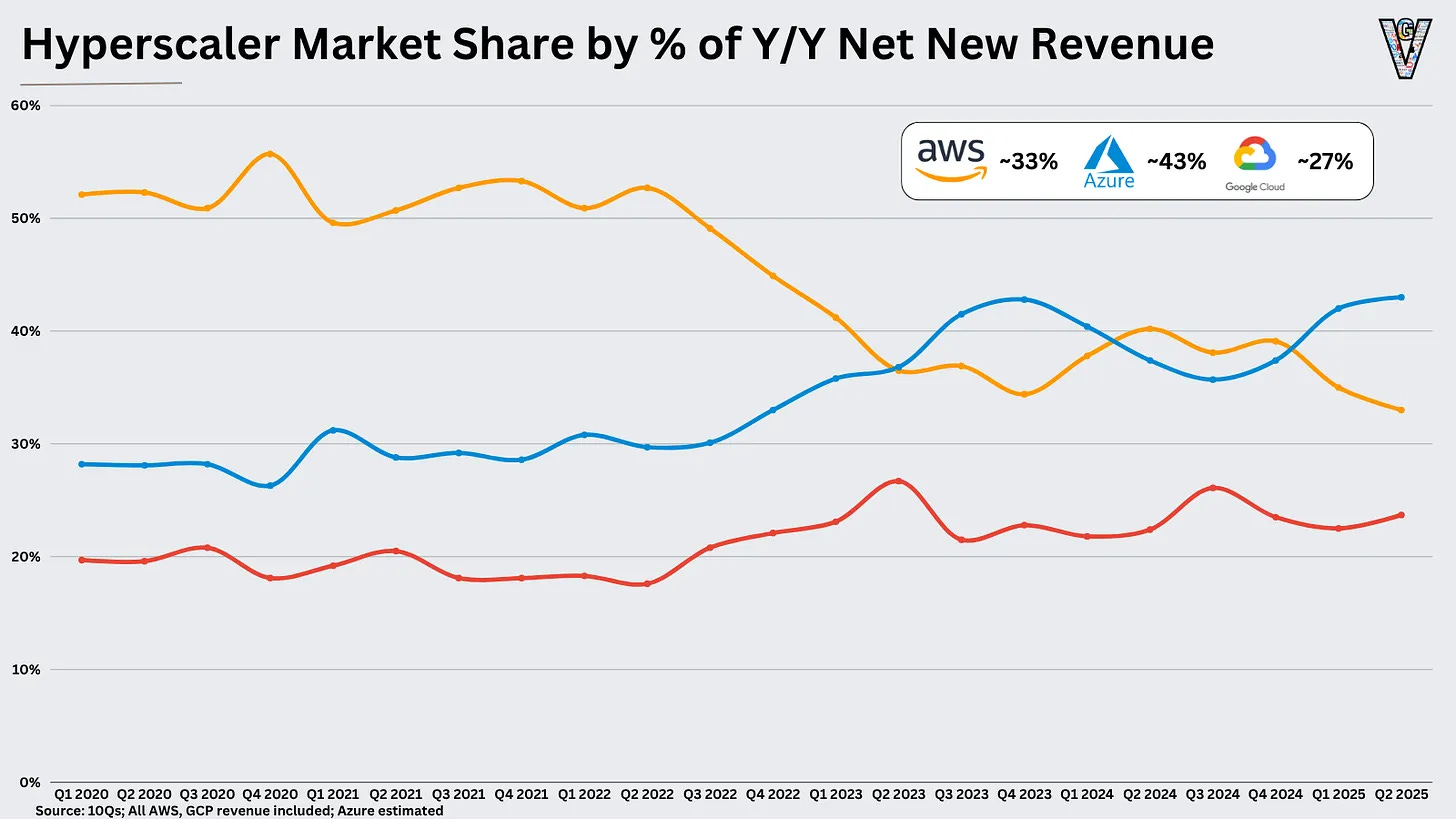

To that end, Eric has another insightful chart, namely a “CSP market momentum” chart:

We can annotate Eric’s momentum chart to denote key points in the GenAI timeline.

What’s most concerning (or exciting depending on which company you work for) is the change in AWS market share since the rise of LLMs. Net new revenue has taken a serious hit since public awareness of LLMs took off.

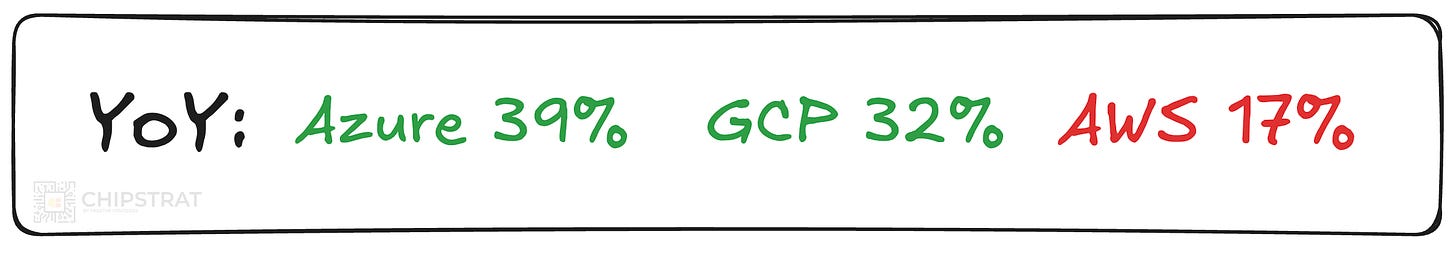

This brings us back to that YoY growth we mentioned at the top of the article

Microsoft’s Intelligent Cloud: 39%

Google Cloud: 32%

AWS: 17%

AWS is not just another business unit for Amazon; it’s the profit engine. And right now, in the middle of the AI infrastructure landgrab, that engine is losing momentum!

Worse, Amazon is GPU-constrained; it can’t fully capture current AI demand even where it has willing customers, leaving revenue on the table while rivals with more capacity lock in long‑term workloads.

Andy Jassy acknowledged as much on the Q2 call — capacity, not demand, is the bottleneck.

Douglas Anmuth, JPMorgan: On AWS, we're seeing significantly faster cloud growth among the #2 and #3 players in the space. I totally appreciate that AWS is coming off of a bigger base. But beyond that, do you think the output gap is due more to customer demand or infrastructure supply for both?

Andy Jassy: … We could be doing more revenue and helping customers more, and we are working very hard on changing that outcome and how much capacity we have.

Moreover, power is a problem too!

Andy Jassy: Some of the constraints, they kind of exist in multiple places, the single biggest constraint is power.

AWS is expanding datacenter power availability, but Jassy cautioned it will take “several quarters” to fully resolve. In a once‑in‑a‑generation infrastructure wave, that sounds like an eternity?!

Behind the paywall, we’ll cover

The Chip Problem

Missed Nvidia GPU window

Opportunity for AMD

Datacenter & Power Constraints

Power bottleneck

Possible workaround

What AWS Is Doing Right

AWS Next Steps